When we’re young and agile, most of us look forward to starting a family, buying a nice car, buying a house and making it into a home. Then as we age, we invest money, time, and energy in our kids, our careers, and our social lives. That’s all pretty normal, but when’s the right time to start saving money for retirement? Many of us look at retirement as a big, daunting task. But, if you start early and start smart, you can look forward to retirement as much as you looked forward to the other seasons of your life. As dads (and parents in general), we focus so much on everyone else that we often put ourselves last. Anyone who’s scrimped and saved for holiday shopping or stayed up late wrapping presents or baking cookies knows what I’m talking about.

There are many sites and resources that can help you determine what you should be saving, what type of retirement plan you should have, how long and how much you’ll have to save, and all the other variables that really make people think twice about “looking forward” to retirement. But with this new resource, AceYourRetirement.org, from the Ad Council and AARP, you’ll find simple tips that will help ensure that you’re on track with your retirement savings. Avo, the friendly digital retirement coach, walks you through a series of basic questions in an instant-messenger-type format, which makes the task so much less daunting.

Whether you’re a young dad just starting out, a guy with a couple of school-age kids, or a card-carrying member of the “sandwich generation” (meaning that you’re sandwiched between kids who still depend on you financially and aging parents who need an increasing amount of care, Avo has suggestions for you.

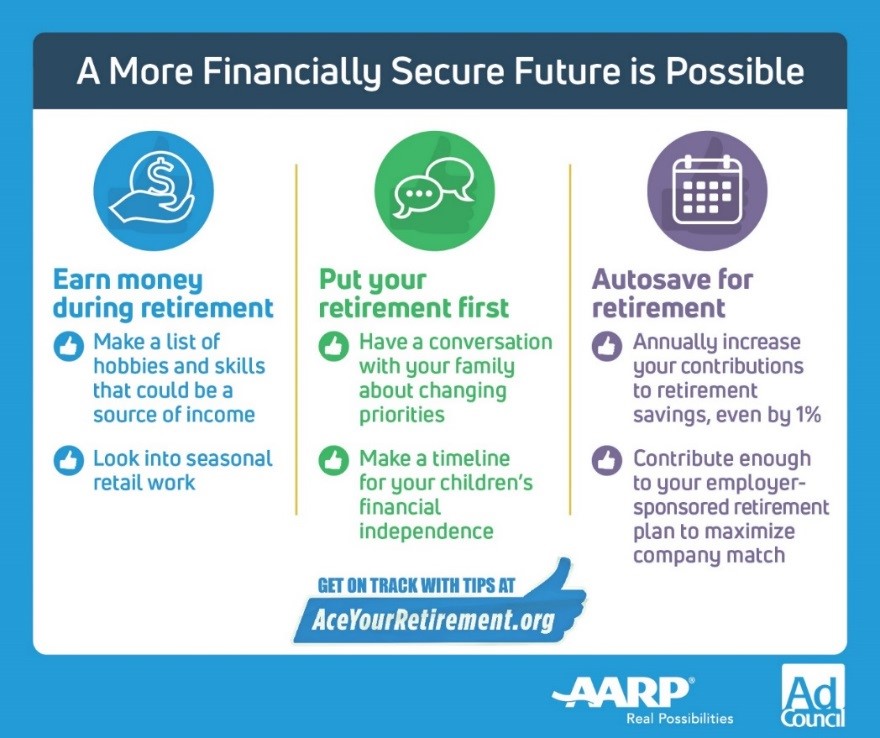

Here are a few tips that may help you maximize your retirement savings:

- While gathered with your family for the holidays, discuss your savings plans and long-term retirement goals, and what steps you can take today to make them easier to achieve. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- Start thinking now about what age you plan to retire and when you plan to start taking Social Security benefits. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match. Hey, it’s free money.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal, part-time work

- Visit www.aceyourretirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.

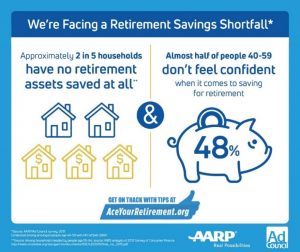

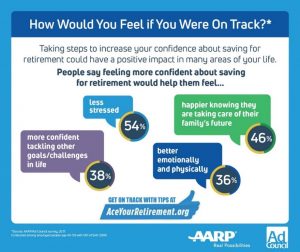

Taking control of your retirement planning could have a positive impact in many areas of your life. According to a recent survey from AARP and the Ad Council, 54% of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed, and 46% would be happier knowing they’re taking care of their family’s future. Having had a few heart-to-hearts with Avo at AceYourRetirement.org,, I know that I feel better.

We work hard for our kids and our family, and now we’re working hard for our own future as well. What are you going to do?